Aion aims to bring purpose back to banking by building neo banks and enabling traditional banks to go digital with certainty.

All of this is done with low capex and reducing time to market.

What we do

Developer of Digital Banking Platform designed to offer banking services on the go.

AION’s SaaS platform enables banks to go digital with speed and certainty,

while being compliant with local banking regulations. On track to sign up

10 million end users.

Deliver the Most Successful

Banks of the Future

Aion provides new value-added self-managing services that combine real-time data insights with security and flexibility and make full use of all the digital banking opportunities to help customers get their best ROI by addressing the Key Transformation Challenges

Business Challenges

Technology Challenges

Flexibility and Mindset, Supporting Your

Digital Growth Ambitions

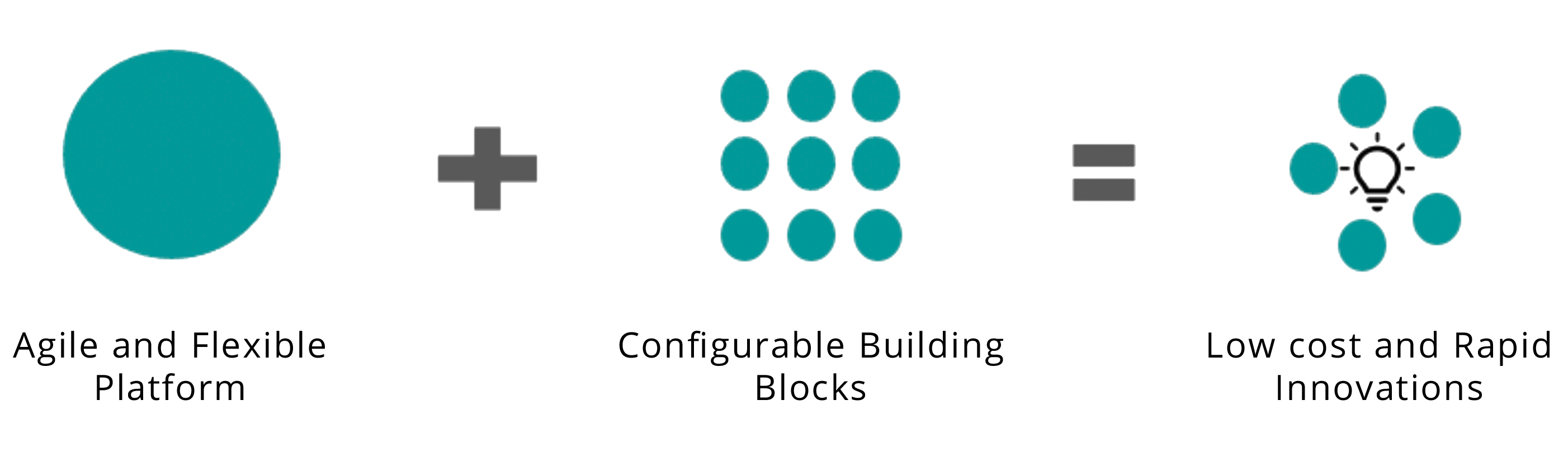

Configurable Building Blocks

– Digital customer onboarding, account opening & product origination

– Secure authentication & identity management

– Workflow and task management

– Flexible product origination process management

– Full spectrum of payments

– Complete suite of business banking products and services, such as Loans, Facilities, Cash Management, Trade Finance, and Investments

– Open banking capabilities (API Gateway)

– Chatbots & conversational banking

– Reports & dashboards

Digital Platform

– Agility and flexibility as the core design principle in platform development and implementation

– Digital Banking Platform services for current and new business models

– Vertical and horizontal scalability

– API-first, with micro-services focus

– Central administration, multi-tenancy, security by design

– Fees, commissions, rules management

– Easy to integrate with any core banking system, internal or external system

– On-premise/hybrid/cloud-agnostic deployment

Digital-first Bank

Lead as a Digital-

only Bank

The Aion Rubix Digital Banking Platform enables banks to accelerate their time to market today and be ready for tomorrow. The platform provides the foundation for digital transformation, the capabilities for exceptional omni-channel experiences, and the technology to leverage digital banking at its best to evolve in to a Digital-First Bank and leap into a Digital Only Bank.

Aion Rubix is deployable on premise or in any public or private cloud.

Aion, Your Technology Partner

5

Markets

5

Clients

6

Products

3

GCC Central Banks’ Approval on Digital Onboarding

12

Mandates to Build Digital Banking Play

12

Digital Customer Journeys Tailored to GCC